Is voluntary pension fund saving less attractive with the new tax regulation of PP 58 and PMK 168 2

The new PP 58 and PMK 168 employee tax deductions (PPh 21) have changed the monthly employee tax deductions. Previously, companies calculated tax deductions based on annualized monthly income minus applicable deductions, including old-age pensions and voluntary pension fund savings to DPLK. The previous regulation allowed employees to get benefits and tax deductions when they voluntarily saved some income for pension funds. However, the new tax regulation requires the basis of a tax deduction on gross income instead of net income after any deduction, including old-age pensions and voluntary pension fund savings. So, during the year, the employee will pay more monthly tax. Still, at the end of the year/December, the employee will benefit from an actual pension fund savings deduction on yearly tax income and even get the tax return from tax overpayment. So, is it better for employees to do more pension fund savings at the end of the year? There are plus and minus; if we see from a cash flow point of a few, yes, it is better to do the pension fund savings at the end of the year, as the employees can use the fund and use the free cash flow from tax benefit at the end of the year. However, if the employees care about the return of the growth of pension fund savings, the employees may sacrifice more tax deductions. Still, the employees must pay taxes first to spread the savings during the year instead of only at the end of the year. The solution is that the employee may reduce the amount of voluntary pension fund savings and use the tax return in December to add more voluntary pension fund savings.

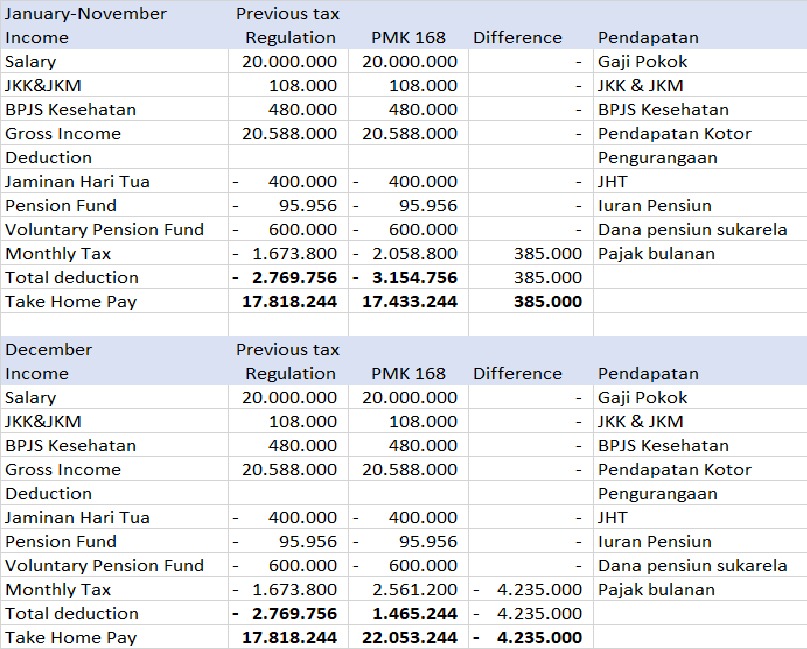

See the illustration of how the new tax regulation treats pension fund savings from January to November and December.