Based on my experience to help client in payroll outsourcing, it is more companies provide gross salary which employees pay PPh21 than companies provide net salary which company pays pph21.

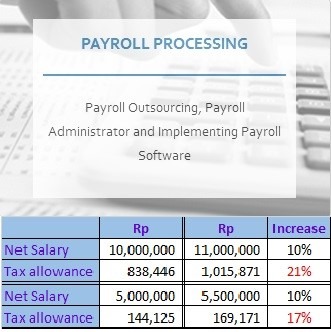

Because calculating PPh21 needs to consider Non Taxable income and tax rate which are starting 5%, 15%, 25% and 30% depended on income per year, a company which gives net salary to the employees will face difficulties in preparing budget especially to calculate tax allowance. The percentage increasing of PPh21/tax allowance will be higher than percentage increasing of salary. This difficulty can lead to incorrectly calculate the tax allowance budget or overbudget at the end of the year.

Sometimes I find the companies that provide nett salary is not only including the tax, but also including 2% BPJS’ (formerly jamsostek)old age pension which is the responsibility of employees to pay. This is certainly benefit to the employees, but it makes more difficult to calculate the budget. When calculating the tax, the company must calculate the additional tax for additional 2% old age pension, because 2% old age pension should be treated as additional income for employees. (Please see on the table for actual percentage increasing of certain salary amounts and tax allowance amounts)

If it is difficult to calculate the budget, why companies still want to use the net salary policy? Based on the experience, HR usually feels easy to process the payroll, the companies can quickly calculate payroll and do not worry to make a wrong tax calculation, because if there any mistakes, it can be revised later when the company will pay PPh21.

Besides, employees usually feel get advantage by the net salary, because they do not need to care on how much deducted PPh21 and the employees get the religious holiday allowance as the same amount of the monthly salary.

Actually, the employee may get disadvantage with the net calculation, when he/she moves to other company. Because tax allowance should be calculated according to the periods of employment. When an employee resigns, the company will get the tax allowance return, so it can be happened, his/his tax will be underpayment at the end of the year.

If the above are the advantages and disadvantages of the net salary, now we evaluate why more companies use the gross method. The basic principle of PPh21 is a company should withhold tax on the income of employees, so this is the basis why more companies provide gross salaries to employees. Unlike net method, accordingly the company can make a budget based on gross salary without having bother with tax allowance. This is why I help a client which converted from net salary to gross salary. Because management found difficulties in calculating the annual budget.

The assignment of converting from net to gross is not an easy task, because basically the employee should not be aggrieved. However there is a difference assumption between calculating tax for monthly salary and tax for religious holiday allowance . Based on tax regulation. the monthly tax is calculated based on the monthly income of a year, whereas the tax of bonuses or religious holiday allowance is based on the highest tax rates of his/her income. So that employees usually receive a monthly salary of holiday allowance will feel aggrieved and receive smaller than monthly salary.

Another important thing in calculating the gross salary, the company should be able to calculate the tax when processing the payroll, the company with a lot of employees needs to use a software or outsource the payroll in order to calculate tax accurately.

Now what are the benefits for employees to obtain gross salary? Based on the basic principles of pph21, PPh21 is an employee should pay the tax which deducted by the company where he/she works and the company pay to the State. Government periodically evaluate the Non Taxable Income and when government increases the limit of non taxable income which is happened in 2013, then this increasing Non Taxable Income becomes the benefits for the employee because he/she gets a tax deduction. It has been happened the government was lower tax rates and changed taxable income limit on every rate, this will make benefit to the employees by less tax payments.

If the employee moves to other company, then the employee gets a tax refund and needs to report the income and paid taxes to the new employer, so that at the end of the year there is no shortage of tax payments.

That are all advantages and disadvantages of gross and net salary policy. If there are any question including changing from net to gross, you can contact. sutjipto@widyapresisisolusi.com